This article is apart of our weekly series associated with the The Global Subsidiary Index. The series is designed to help businesses identify the best countries for establishing a subsidiary based on key operational factors. GEOS provides a data-driven ranking of jurisdictions worldwide, assessing across 40+ criteria to bring you insights into global expansion opportunities.

Each country on the index is scored on an overall score out of 100, with each individual criterion out of 5 or 10. Higher scores indicate a more favorable environment for businesses. By leveraging these insights, companies can make informed decisions on where to establish a legal presence.

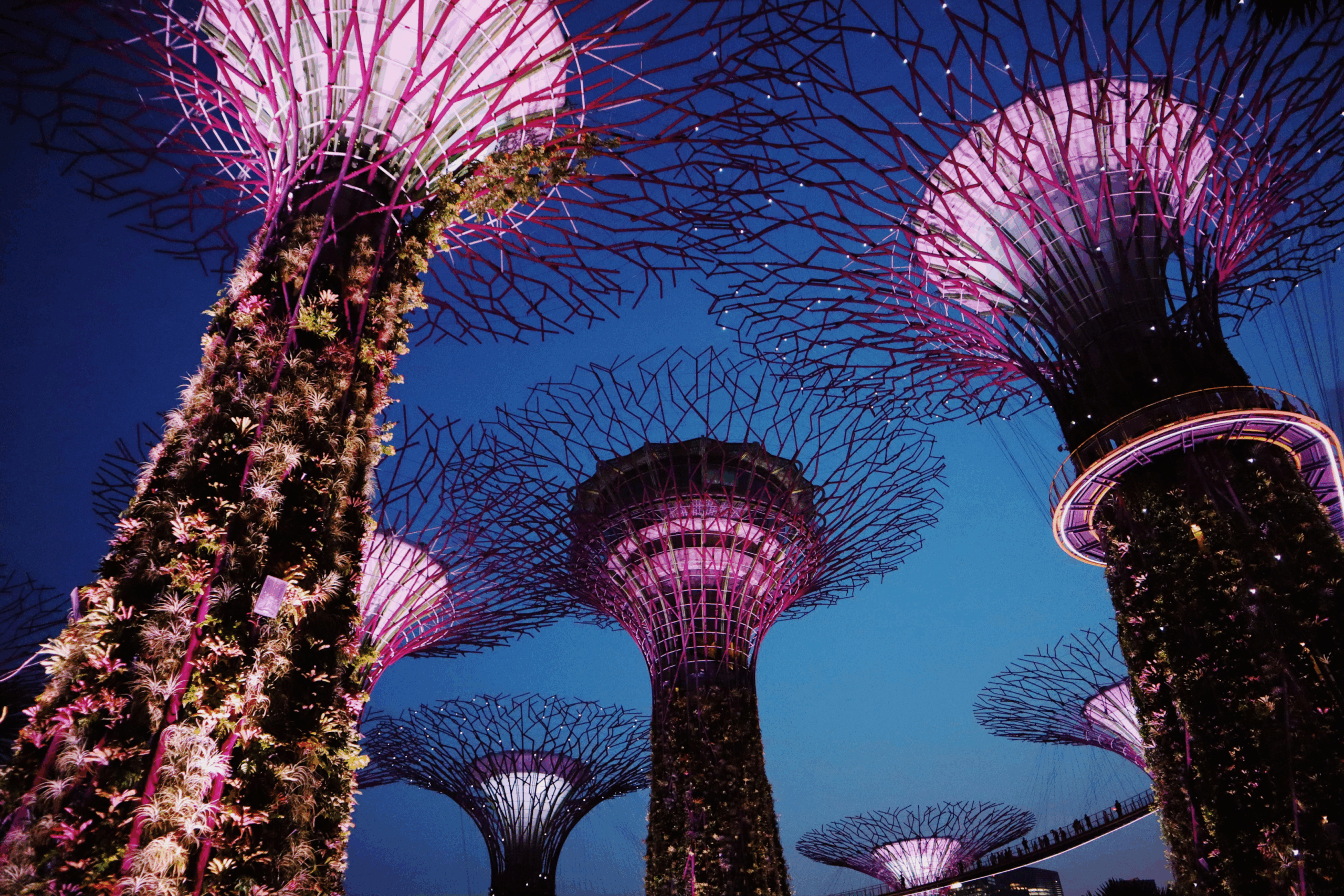

Thinking of registering a company? Singapore is a solid choice. Good things come in small packages, and Singapore proves it. This compact city-state sits at the crossroads of global trade. It’s a stable, high-income economy with strong infrastructure, clear regulations, and a skilled workforce.

Singapore is also a magnet for global tech. It’s home to 80 of the top 100 software and service companies, including Google, IBM, Meta, and Amazon Web Services. These firms provide the digital tools that drive transformation for businesses across the region.

It’s a service-first economy with global reach, built on strong industries like finance, tech, logistics, and advanced manufacturing. Singapore has solid trade ties with China, Malaysia, the U.S., and Hong Kong, which makes it a great base for doing business across Southeast Asia.

If you’re thinking about expanding into Asia, Singapore is a smart place to begin. In this guide, GEOS walks you through what it takes to set up, stay compliant, and grow your company in Singapore with confidence.

Why Should You Expand to Singapore?

If you’re looking for a stable, well-connected market with real growth potential, Singapore stands out. Here’s why you should expand your company in Singapore.

A Premier Hub for Global Business

Singapore continues to punch above its weight in global business. It ranks near the top worldwide for ease of doing business, with a GEOS Global Subsidiary Index Score of 89.2. The government backs growth with clear regulations, strong legal systems, and low corruption.

With a perfect GDP per capita score, Singapore has high purchasing power and a well-educated population. It also scores 5/5 for political risk, thanks to stable leadership and transparent governance. Businesses face fewer unknowns here than in most other markets.

Connectivity is a major strength. Singapore ranks second in Asia for digital competitiveness and offers world-class IT and logistics infrastructure. Changi Airport, named the World’s Best Airport in 2025, shows just how well the country supports global movement.

Nearly half of international companies in ASEAN already operate in Singapore. Its central location, bilingual talent pool, and few cultural barriers make it a natural hub for regional growth.

The country also leads in innovation. Programs like the Smart Nation Initiative, Digital Connectivity Blueprint, and National AI Strategy keep it ahead in tech and R&D.

If you’re expanding into Asia, Singapore gives you the scale, stability, and speed to move with confidence.

The first platform dedicated to streamlining entity setup and management.

Competitive Tax & Business Incentives

Singapore makes taxes simple and competitive. The flat corporate tax rate sits at 17%, earning a 9/10 score for attractiveness. New companies can qualify for generous exemptions.

The corporate income tax structure is progressive for newly established businesses, with specific rates for different income brackets and exemptions available for foreign income. Startups may get up to SGD 125,000 in tax relief on their first SGD 200,000 of income.

Other companies can claim up to SGD 102,500. In 2024, businesses also received a CIT rebate of up to SGD 40,000, plus a cash grant of SGD 2,000 for eligible firms. Singapore’s one-tier system means dividends paid to shareholders are tax-free. That cuts down on double taxation and keeps things efficient. Additionally, Singapore does not levy taxes on capital gains, making it an attractive destination for investors.

Payroll contributions are clear and manageable. Employers contribute to the Central Provident Fund (CPF) for Singaporean and permanent resident employees. The system is easy to navigate, which is why Singapore earns a 4/5 score here.

Larger companies benefit from a tax framework that aligns with global standards. The new Multinational Enterprise (Minimum Tax) Act ensures a minimum 15% effective rate for in-scope groups. But Singapore hasn’t adopted the undertaxed profits rule, keeping its tax environment less restrictive than some peers.

The setup process is smooth. With a 10/10 ease of doing business score, companies can register quickly and avoid unnecessary delays.

In short, Singapore rewards growth. The tax system supports both startups and global firms, offering real incentives to operate and expand. Singapore offers various tax incentives, such as tax exemptions for newly incorporated companies and favorable corporate tax rates, making it an attractive destination for startups and foreign investors looking to minimize their tax liabilities.

Skilled Workforce & Favorable Hiring Regulations

Singapore delivers more talent than its size might suggest. It has a highly educated, multilingual workforce with strong skills across key business areas. The country scores 5/5 for talent availability in engineering, sales, marketing, finance, and IT. Most professionals speak English and at least one other language, making collaboration smooth.

It ranks second in the world for English proficiency and has a 97.6% adult literacy rate. Over 70% of residents can read two or more languages. Global companies like UBS, HP, and Siemens point to Singapore’s talent pool as a major reason they set up operations here.

Hiring rules are clear and easy to follow. Singapore earns a 10/10 score for employment law complexity. Contracts, benefits, and terminations follow set guidelines, with minimal red tape. Unions exist but rarely cause disruption. They typically support business goals, which is why Singapore scores 4/5 for union complexity.

- Written contracts must include job scope, pay, hours, and leave.

- CPF contributions are required for Singaporean and PR employees. Employers cover 17%.

- Work passes like the Employment Pass and Tech.Pass help bring in foreign talent quickly.

The government also invests in local talent. Programs like SkillsFuture offer training and funding to help employers grow strong teams.

Singapore makes it easy to hire and retain the people you need. The talent is here, the systems work, and the rules are built for business.

How to Set Up a Business in Singapore

Whether you’re setting up a private limited company in Singapore or exploring other business structures, understanding the company registration process is the first step. Here’s what you need to know to get your company in Singapore up and running.

Choosing the Right Legal Structure

Choosing the right legal structure in Singapore depends on what you want to achieve and how much risk you’re willing to take. A Singapore private limited company is a strong option for most foreign businesses.

A private limited company offers limited liability, so your personal assets stay protected. It’s a separate legal entity, which makes it easier to open bank accounts, sign contracts, and hire employees. You also get access to Singapore’s tax benefits, like start-up exemptions and a 17% corporate tax rate.

Another option is operating as a sole proprietorship. The registration process is straightforward, and it offers simplicity in management. However, the owner is personally liable for all debts and obligations, which means personal assets are at risk. Despite this, it can be beneficial for small businesses due to less government compliance obligations and costs compared to other business types.

If you’re still exploring the market, a Branch Office or Representative Office might suit you better. A Branch Office lets your overseas company operate in Singapore without creating a new business entity. But the parent company stays fully liable for its actions. It works well if you want to maintain control and aren’t worried about taking on risk.

A Representative Office is the lowest-commitment option for a new company in Singapore. It can’t sell, sign contracts, or earn revenue. It’s only for research, networking, or setting up early-stage plans. It’s a good fit if you’re not ready to launch but want to learn more about the market.

To sum it up:

- Private Limited Company gives you liability protection and room to grow. For example, you may want to set up a private limited company if you’re planning to raise capital, hire employees, or expand across borders

- Sole Proprietorship offers simplicity and lower costs but comes with personal liability.

- Branch Office keeps everything under your main company but carries more risk.

- Representative Office helps you explore the market without jumping in too fast.

- Limited Liability Company in Singapore is a separate legal entity, meaning it’s responsible for its own debts and obligations.

Registering a company in Singapore is easy once you decide which form you’d like your business to take.

Choosing a Business Entity

When choosing a business entity, it is essential to consider the company’s goals, size, and structure. A private limited company is a separate legal entity from its shareholders and directors, providing limited liability protection and tax benefits.

The Singapore Companies Act governs the incorporation process, and the Accounting and Corporate Regulatory Authority (ACRA) is responsible for regulating and overseeing the registration of companies in Singapore. Foreign companies can also register a subsidiary company or a branch office in Singapore, which can provide access to the local market and take advantage of the country’s business-friendly environment.

Company Name and Registering a Company in Singapore

The first step in company incorporation is to reserve a unique company name with the Accounting and Corporate Regulatory Authority (ACRA). The name must be approved by ACRA before the company can be registered. Once the name is approved, the company can be registered with ACRA, and a certificate of incorporation will be issued.

The Singapore company registration process typically takes one to three days to complete. It is essential to note that the company name must comply with the Singapore Companies Act and must not be identical to an existing company name or trademark.

Registered Filing Agent and Resident Director

To incorporate a company in Singapore, a registered filing agent is required to handle the company registration process. The agent will ensure that all necessary documents are filed with ACRA, and the company is registered correctly.

Additionally, a resident director is required for every Singapore company. The resident director must be a Singapore citizen, permanent resident, or a foreigner with a valid Employment Pass. The resident director is responsible for ensuring that the company complies with all relevant laws and regulations in Singapore.

Office Address and Business License

Every Singapore company must have a registered office address, which must be a physical address in Singapore. The office address will serve as the official address of the company and will be used for all official communications.

Depending on the type of business, a business license may be required. The license must be obtained before the company can commence business operations. It is crucial to ensure that the office address is a physical address and not a post office box, as this is a requirement for company registration in Singapore.

Company Incorporation in Singapore & Compliance Essentials

Getting your company in Singapore started is easier than you might think. The company registration process is fast, digital, and efficient. You file everything through ACRA’s online portal, and most businesses complete basic company registration in just a few days. The full timeline, including documents, certifications, and follow-up steps, usually takes 1 to 2 months.

To facilitate a seamless company registration process in Singapore, it is crucial to have all the necessary documents prepared in advance.

Singapore keeps paperwork simple. It earns a 4/5 score for original documentation, thanks to clear requirements and minimal notarization.

Here’s what the process looks like:

- Online submission: Apply through ACRA’s portal with key business details.

- Light paperwork: Provide ID for directors and shareholders, along with a few certified forms.

- Quick turnaround: Initial company registration typically takes less than a week.

- Next steps: Opening a business bank account is an essential requirement for business operations, and it involves submitting detailed KYC documents.

- Open a corporate bank account, which helps in managing finances separately from personal accounts, crucial for tax and accounting purposes

- Apply for relevant business licenses

- Register for GST if your revenue exceeds the threshold

With everything in place, you can go from idea to incorporated business in just a few weeks. Singapore’s system helps you start strong without the usual red tape, including a simplified bank account opening process.

Representative Office and Market Research

A representative office can be set up in Singapore to conduct market research and explore business opportunities. The representative office is not considered a separate legal entity and is not allowed to engage in any business activities that generate income.

However, it can be used to promote the parent company’s products or services and to gather information about the Singapore market. Foreign companies can also set up a subsidiary company in Singapore, which is a separate legal entity from the parent company. The subsidiary company can engage in business activities and generate income, and it is subject to Singapore tax laws.

Post-Incorporation Requirements

After incorporating a company in Singapore, there are several post-incorporation requirements that must be complied with. These include opening a corporate bank account, which is necessary for separating business and personal finances, having at least one shareholder and registering for taxes with the Inland Revenue Authority of Singapore.

The company must also appoint a company secretary, who is responsible for ensuring that the company complies with all relevant laws and regulations, and obtain any necessary business licenses and permits. Additionally, the company must have a local registered address, which can be a residential or commercial address, and must file annual returns with ACRA. It is recommended that companies engage a registered filing agent to assist with the incorporation process and ensure that all necessary documents are filed correctly.

Financial & Corporate Bank Account Considerations

Singapore offers a strong financial base for global business. It scores 5/5 for financial infrastructure, with reliable banks, stable regulations, and easy access to global markets. Companies can set up corporate accounts, manage regional cash flow, and raise capital with confidence.

Having a business bank account is crucial for managing finances separately from personal accounts. Financial institutions view a Private Limited Company (Pte Ltd) as a more credible business structure compared to sole proprietorships or partnerships, leading to easier access to funding for business expansion.

The country is also a hub for investment and trade finance. You’ll find full banking services, including FX, loans, and asset management—all backed by clear rules and strong oversight from the Monetary Authority of Singapore (MAS).

At the same time, tax and accounting standards are strict. Singapore earns a 6/10 score for tax and accounting complexity. The rules are transparent, but businesses must stay compliant. Companies that exceed certain thresholds (SGD 10 million in revenue or assets, or 50 employees) must complete an annual audit.

- Corporate tax filings must follow Singapore Financial Reporting Standards (SFRS). Preparing financial statements is essential for tax and accounting purposes, and they must be filed with regulatory bodies to maintain transparency and accountability.

- Statutory filings have firm deadlines and require detailed documentation.

- Banking setup may involve submitting detailed KYC documents, especially for foreign-owned firms.

- Audit exemptions apply only to smaller companies that don’t cross any of the key thresholds.

Singapore also plays a growing role in regional infrastructure financing. Infrastructure Asia brings together investors, developers, and government agencies to support major projects across Southeast Asia. MAS has backed efforts like the Infrastructure Debt Distribution Facility, which helps private capital invest through securitized infrastructure loans.

In short, Singapore gives you strong financial tools, dependable oversight, and access to one of Asia’s most dynamic capital markets.

Things To Consider When Expanding into Singapore

Expanding into Singapore comes with a lot of upside, but it’s not something to rush into. From choosing the right business structure to understanding local compliance requirements, there are a few key things to consider. Here’s what to keep in mind before setting up your business in Singapore.

Immigration, Employment Pass & Work Permits for Foreign Employees

Singapore makes it relatively straightforward for businesses to hire foreign talent. It earns a 5/5 Immigration Complexity Score for clear and predictable processes. The most common option is the Employment Pass (EP) for professionals earning at least SGD 4,500 a month.

You can also apply for:

- S Passes for mid-level staff

- Work Permits for semi-skilled roles

You apply through the Ministry of Manpower (MOM) portal. Processing is usually fast if the documents are in order. Work passes are tied to the employer and must be renewed based on updated criteria.

That said, Singapore has tightened its policies in recent years. The government encourages local hiring and expects companies to follow the Fair Consideration Framework. You’ll need to advertise roles locally before offering them to foreign candidates.

As one of the most densely populated cities in the world, Singapore also focuses on social balance. Newcomers are welcome, but they’re expected to integrate. Employers play a role in that, too.

In short, hiring foreign employees is doable. Just follow the process, stay compliant, and build a team that reflects both local and global strengths.

Cost of Living & Office Space

Singapore offers high-quality office space and strong infrastructure. But it comes at a price. Rent in Singapore is about 6.1% higher than in London, and the overall cost of living is 2.0% higher, excluding rent. If you’re setting up a team, be ready for higher real estate and daily expenses.

Premium areas like Marina Bay and Raffles Place are the most expensive. They offer great access, top amenities, and a strong business presence. But not every company in Singapore needs a downtown address.

- Fringe districts like Jurong East or Paya Lebar cost less and still offer good connectivity.

- Coworking spaces are a flexible, affordable option for smaller teams or early-stage operations.

Even with the high prices, you get value, including fast internet, clean buildings, and efficient transport. Singapore continues to invest in infrastructure, which helps keep things running smoothly.

It’s not the cheapest place to run a business, but it’s reliable, modern, and offers room to grow.

Regulatory & Compliance Risks

Singapore keeps its compliance process clear and structured, but it expects businesses to follow the rules closely. It earns an 8/10 Compliance Reporting Score for strong corporate governance and regular checks by regulators like ACRA and IRAS.

If you expand to Singapore, here’s what you need to know:

- Annual filings are mandatory, even for dormant companies. You’ll need to submit annual returns to ACRA and tax filings to IRAS.

- Appoint an auditor within three months of incorporation unless your company in Singapore qualifies as a small company (under SGD 10M revenue or assets, and fewer than 50 employees).

- Determine your financial year end (FYE) early. Keeping it within 365 days can help you qualify for start-up tax exemptions.

- Register for GST if your annual taxable revenue exceeds S$1 million. You must do so within 30 days of becoming liable.

- Notify ACRA of any major business changes, like updates to directors, shareholders, or share capital.

You’ll also need to meet basic employment compliance. For local hires, CPF contributions are required. If you’re hiring only foreign staff on work passes, CPF doesn’t apply, but you must still contribute to the Skills Development Levy (SDF).

Singapore’s compliance framework helps protect your brand and builds trust with partners and regulators. It’s strict, but predictable, and easy to manage if you stay organized.

Talent Availability & Scaling Considerations

Singapore gives businesses a strong base to scale. It scores 4/5 for industry diversity, with strengths in finance, tech, logistics, healthcare, and advanced manufacturing. If you’re expanding, you’ll find skilled talent and mature industries that support long-term growth.

Manufacturing plays a big role in the economy. It contributes 20–25% of the country’s GDP. But it’s not just basic production—Singapore focuses on high-value sectors like precision engineering and biomedical sciences.

- 60% of the world’s micro-arrays are made in Singapore

- One-third of global mass spectrometers are produced here

The country is also a major hub for refined oil, chemicals, and electronics. Many companies have already adopted Industry 4.0 technologies like automation, Iot, robotics, and 3d printing to boost productivity.

Language is another advantage. Singapore scores 5/5 here. English is the main language for business, government, and education. Most people also speak a second language—usually Mandarin, Malay, or Tamil. That makes regional communication easier.

In short, Singapore gives you the workforce, sector depth, and language skills to scale fast and run smoothly.

Unique Singapore Expansion Insights

Expanding to Singapore comes with a few important details that are easy to miss but make a big difference for foreign business owners.

First, you need at least one local director. This person must be a Singapore citizen, permanent resident, or someone with a valid work pass. Many foreign companies solve this with a nominee director service, which keeps things simple and compliant. A foreign parent company can establish a branch office in Singapore, maintaining the legal identity of its overseas counterpart.

Additionally, setting up a holding company in Singapore can offer significant advantages, including tax optimization, risk management, and effective consolidation of operations. A holding company can manage and control subsidiary companies, making it easier to streamline operations and reduce risks.

Singapore also offers a wide range of government incentives. Singapore’s Avoidance of Double Taxation Agreements (DTAs) help minimize or eliminate taxes on foreign-sourced income, making it an attractive option for company incorporation. Agencies like Enterprise Singapore and EDB support businesses in tech, R&D, automation, and international expansion. If your business brings in high-value projects or innovation, you could benefit from:

- Pioneer Tax Incentive: full tax exemption for up to 15 years.

- Development and Expansion Incentive: reduced tax rates (5% to 15%) for scaling or upgrading.

- Enterprise Innovation Scheme: 400% tax deductions or a cash payout for R&D, IP, and training.

- Double Tax Deduction for Internationalisation: claim double deductions for approved overseas growth activities.

On the cultural side, relationships matter. Singaporeans value punctuality, professionalism, and trust. Deals can take time, especially at the start. Face-to-face meetings go a long way.

- Always introduce your senior team first.

- Don’t be surprised by personal questions. They’re part of building rapport.

- Respect hierarchy and speak clearly and directly.

Singapore is also culturally diverse. Most business settings are inclusive, but being mindful of religious or cultural norms shows respect.

In short, set up with the right structure, use the incentives available, and take the time to build strong business relationships. It’ll help you grow faster and avoid missteps.

How GEOS Simplifies Your Expansion into Singapore

Singapore ranks 11th in the world for GDP per capita, a sign of its strong economy, high consumer spending power, and stable business environment. That’s why so many companies choose it as their entry point into Asia.

Corporate service providers play a crucial role in minimizing company registration costs for startups and the fees associated with their services. They offer various packages that include essential services like document preparation and nominee directorship, making it important to select a provider that balances quality and cost-effectiveness.

With a GEOS Global Subsidiary Index Score of 89.2, Singapore stands out as one of the most attractive and straightforward markets for global expansion. Still, setting up in a new country takes time, local knowledge, and a clear plan. That’s where GEOS comes in.

We Handle the Details, So You Don’t Have To

From incorporation and nominee director services to registered office addresses, we take care of the basics. We also manage compliance, tax filings, and accounting, so you stay on track without getting bogged down in admin. Registering a company in Singapore is easy with GEOS.

AI-Powered Help, Always On

Think of Geovanna as your local expert, available anytime. She helps you manage paperwork, keep up with deadlines, and understand local regulations. It’s like having a local expert guiding you every step of the way.

Thinking About Singapore?

If you want a secure, efficient base in Asia, Singapore makes sense. It’s modern, well-connected, and full of opportunity. With GEOS, expanding there is simple, smooth, and built for growth.

📩 Contact GEOS to get your custom expansion plan underway.

This article does not constitute legal advice.