Winding down a company involves a structured process to cease business operations and settle financial obligations. This article outlines the essential steps to successfully navigate a company wind down, from planning your strategy to handling legal requirements. You’ll learn how to manage personnel, liquidate assets, and communicate effectively with stakeholders.

Key Takeaways

Effective planning, including financial assessments and asset liquidation strategies, is essential for a successful company wind down.

Clear and transparent communication with employees, investors, and other stakeholders helps maintain trust and manage expectations during the closure process.

Legal compliance, including drafting a Plan of Dissolution and settling all tax obligations, is crucial to avoid legal repercussions during the wind down.

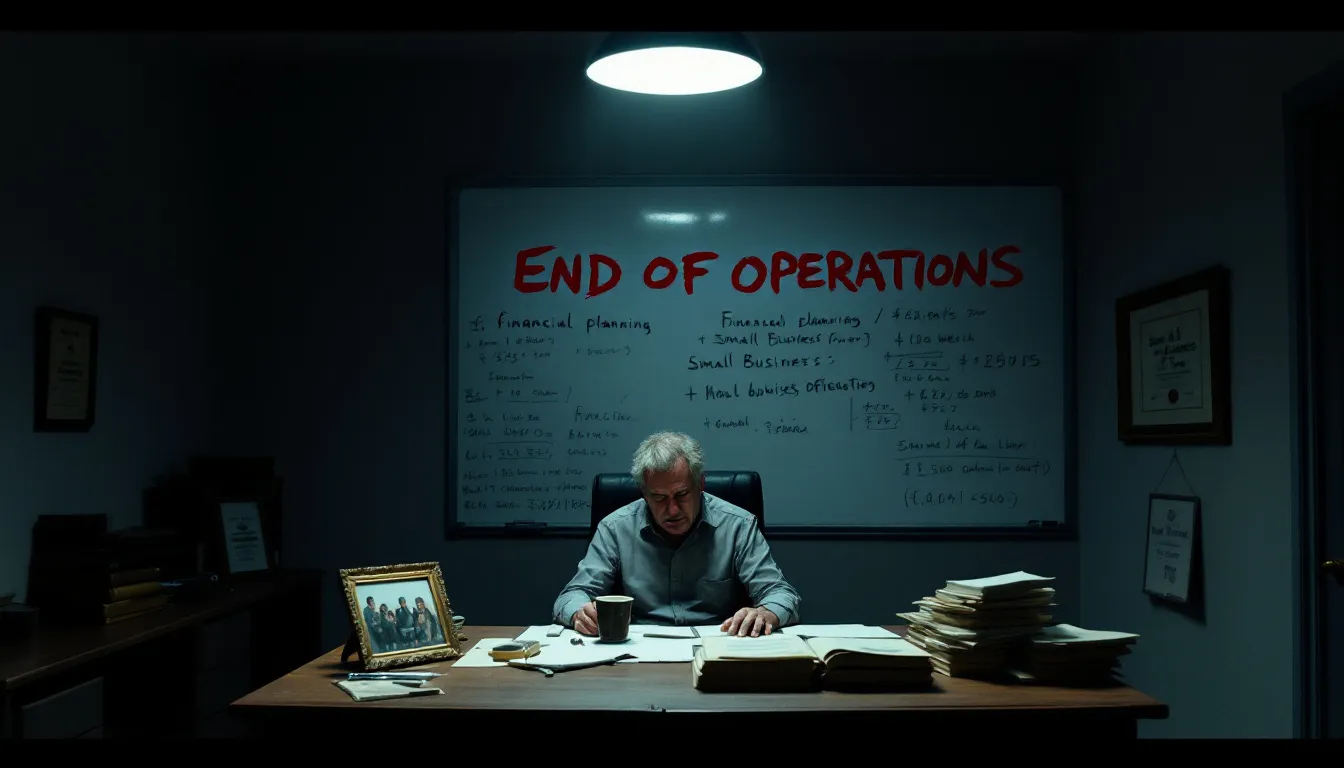

Planning Your Wind Down Strategy

Effective planning is crucial for a successful business wind down, enabling control over ceasing operations and settling with creditors. Key areas to manage include cash flow, asset liquidation, and employee terminations. Strategic insight and operational experience help minimize liabilities and ensure an efficient process. Obtaining legal advice tailored to the specific circumstances of your company is essential to navigate the complexities of corporate dissolution.

Dividing tasks into smaller, manageable parts helps address the multifaceted and time-intensive nature of winding down.

Assess Financial Health

The first step in planning your wind down strategy is to assess your company’s financial health. This includes monitoring customer receivables for timely collections and frequently revising cash flow projections. Understanding your runway—the length of time your startup can operate with its current resources—is crucial for determining your financial standing. Additionally, consider all liabilities such as taxes, payroll, vendor contracts, and refunds. Obtaining legal advice tailored to your company’s specific financial situation is essential to navigate the complexities of corporate dissolution.

Assess your company’s financial health.

Monitor customer receivables for timely collections.

Frequently revise cash flow projections.

Understand your runway—the length of time your startup can operate with its current resources.

Consider all liabilities such as taxes, payroll, vendor contracts, and refunds.

Inventory all company equipment and assess liquid assets to gauge your ability to cover expenses and liabilities. This comprehensive financial assessment aids in making informed decisions about liquidating assets and settling debts.

Create a Wind Down Timeline

A clear timeline for operational tasks during the company’s wind down is vital to avoid chaos. Prepare a detailed checklist covering all aspects of the wind down, including key tasks and responsible parties.

Segment these tasks into manageable parts to facilitate effective management and ensure a smooth transition.

Identify Key Stakeholders

Involve key stakeholders such as executives, board members, professionals, regulatory agencies, and attorneys for a successful wind down. Executives lead decision-making and the wind down process, while board members provide necessary governance.

Shareholders and the board of directors must approve the Plan of Dissolution to proceed with the wind down.

Managing Personnel During Wind Down

Managing personnel during a business wind down is one of the most challenging aspects. Effective communication is crucial for maintaining trust and goodwill among employees and stakeholders.

Empathy, integrity, and professionalism in communication about the closure can mitigate negative reactions and foster trust.

Plan Employee Terminations

Carefully consider several factors when planning employee terminations. Adhere to COBRA, payroll, W-2, and EEO requirements to comply with labor laws. When informing employees about layoffs, consider their value to the company, job market prospects, responsibilities, and performance.

Offer guidance on final payroll timing, available benefits, and transition assistance. Clear communication about layoff timelines helps manage expectations and reduce uncertainty.

Ensure access to necessary accounts, bank logins, and data before losing key personnel to maintain smooth operations during the transition.

Offer Severance Packages

Severance packages provide financial support and demonstrate goodwill as employees transition out of the company. These may include monetary compensation based on years of service, continued health care benefits, and job placement assistance.

Offering severance packages and additional benefits helps maintain positive employee relations and protect the company’s reputation during a wind down.

Maintain Clear Communication

Clear, transparent communication is key to managing employee emotions and workplace morale during the wind down. Providing adequate information about plans and timelines helps employees understand what to expect. Expressing gratitude for their contributions and explaining the reasons for dissolution helps maintain trust and morale.

Regular updates and transparency help manage expectations and reduce uncertainties.

Handling Assets and Liabilities

Handling assets and liabilities is a critical part of the wind down process. Monitoring customer receivables ensures timely collections, and updating cash flow projections regularly reflects changing circumstances. Selling product lines or intellectual property can enhance cash flow.

The dissolution plan should outline how the company will settle debts and manage asset distribution. Finalizing payment terms with vendors and processing all outstanding payments and transactions are essential to prevent unexpected expenses.

Liquidating Assets

Liquidating assets may involve selling directly to consumers or using auction services to maximize returns. Market demand can significantly influence pricing strategies. Selling product lines or intangible property can provide substantial opportunities.

Settling Outstanding Liabilities

Analyze the company’s balance sheet to list all outstanding liabilities and identify any unrecorded ones. A wind down allows management to negotiate individually with creditors regarding outstanding debts. If the company owes money to secured creditors, their right to foreclose on assets may become a paramount issue.

Monitor the burn rate with critical vendors, assess payment terms, and determine if these vendors are necessary during the wind-down phase.

Addressing Tax Obligations

Ensure all tax obligations, including income and payroll taxes, are settled before officially dissolving. Final tax returns must be filed before dissolution to comply with regulations.

Failure to pay payroll taxes can result in personal liability for company officers.

Legal Requirements and Compliance

Compliance with legal requirements is essential in the wind down process. Involving regulatory agencies and attorneys ensures proper oversight. Delaware law requires businesses to publish a notice of dissolution in a newspaper.

Companies may opt for dissolution when they do not need bankruptcy protection and wish to avoid filing for bankruptcy. This can save on costs and simplify the process.

Shutting down a Delaware corporation involves legal, tax, and operational steps. Companies must file federal tax returns (Form 1120), state tax returns, and employer tax returns when closing a business. Settling tax obligations may involve paying taxes owed and filing final tax returns.

Compliance with the WARN Act may require advance notice of layoffs or closures. All employee terminations must comply with local labor laws to avoid legal repercussions. Documenting reasons for employee terminations helps prevent wrongful termination claims.

Drafting a Plan of Dissolution

A Plan of Dissolution outlines steps to wind down operations, settle debts, and distribute assets. Approval from the board of directors and stockholders is required to dissolve the company. Companies may choose dissolution over bankruptcy to avoid the complexities and costs associated with bankruptcy protection.

Operational tasks during a company wind down include transferring or deleting sensitive data, reviewing contracts, and managing remaining obligations.

Filing Corporate Dissolution Paperwork

Filing corporate dissolution paperwork is a critical step in maintaining corporate existence. In Delaware, for instance, a Certificate of Dissolution must include the corporation’s name, effective date of dissolution, and confirmation of fulfilled legal obligations.

Settle outstanding franchise taxes before submitting dissolution documents in Delaware.

Final Tax Returns

When closing a business, file final tax returns with both federal and state authorities. The final tax return submitted to the internal revenue service should explicitly state that it is the company’s last return.

Settle all outstanding tax obligations before officially closing the business.

Communicating with Stakeholders

Effective communication with stakeholders is crucial during a wind down. Expressing appreciation for employees’ contributions when announcing a closure helps foster goodwill. Transparent communication about the process to all stakeholders, including investors, customers, and vendors, is essential for managing expectations and minimizing disruption.

Informing Investors

Engage investors early in the wind down decision to avoid surprises and discuss challenges transparently. Before dissolution, reach a mutual agreement with investors on the decision to dissolve and a plan for distributing remaining assets.

Maintain open communication with investors throughout the dissolution process to ensure transparency and trust.

Notifying Customers

Clearly inform customers about the reasons for closure and any outstanding obligations.

Use multiple communication platforms to ensure customers receive timely updates about the closure.

Engaging Vendors

Negotiate payment arrangements or settlements with vendors to manage costs effectively. Terminate contracts with vendors promptly to avoid incurring additional costs.

Obtain a formal release of liability when a settlement is reached with a vendor.

Alternatives to Winding Down

While winding down might seem inevitable, evaluate if your current business model can adapt to market demands.

Exploring alternatives might provide new opportunities and potentially save the business.

Pivoting the Business Model

Conduct market research, gather customer feedback, and explore alternative revenue streams to pivot the business model. Engaging with existing investors or seeking new funding avenues can provide essential capital to help revive the business.

Exploring Acquisition Opportunities

Explore potential acquisition opportunities if the company has valuable assets during the wind down.

Seeking New Funding

Reach out to existing investors when considering new funding options. Seeking new funding sources can involve various strategies, including attracting strategic partners.

Operational Considerations

Operational considerations are essential for a smooth wind down to prevent complications. Secure data access and manage financial accounts as specific steps.

These steps can help mitigate potential legal and financial issues post-dissolution.

Securing Data Access

Securely store all backups of company data in multiple locations before dissolution to ensure accessibility after the company’s closure.

Closing Bank Accounts

Review open bank accounts to determine which need to be closed. Assess authorized signers and analyze the accounts’ status and payment vendors throughout the closing process.

Finalize bank account closures after ensuring all obligations and final payments are managed.

Finalizing Insurance Policies

Evaluate whether existing insurance policies should be canceled or modified based on current needs during the winding down phase.

Review all insurance policies to determine if any coverage is needed during the transition period.

Summary

To sum up, a successful company wind down requires meticulous planning, clear communication, effective management of personnel, and strategic handling of assets and liabilities. By following the steps outlined in this guide, you can ensure a controlled and efficient wind down process that minimizes residual liabilities and maintains trust among stakeholders.

Remember, while winding down a company is challenging, it also provides an opportunity to demonstrate professionalism, empathy, and strategic foresight. Whether you’re proactively planning for potential financial distress or strategically transitioning out of the market, the principles outlined here will guide you through the process with confidence and clarity.

Frequently Asked Questions

What are the first steps in planning a business wind down?

The initial steps in planning a business wind down are to assess the company’s financial health, develop a comprehensive wind down timeline, and identify key stakeholders involved in the process. This structured approach ensures a smooth transition during the winding down phase.

How should employee terminations be handled during a wind down?

Employee terminations during a wind down should be managed with careful attention to legal requirements, including COBRA and payroll, along with clear communication regarding timelines and the provision of severance packages to assist employees in their transition.

What is the importance of liquidating assets during a wind down?

Liquidating assets during a wind down is crucial as it generates the necessary cash flow to settle outstanding liabilities and ensures transparency for investors regarding the distribution of remaining assets. This process is essential for an orderly and fair closure.

What legal requirements must be fulfilled for a corporate dissolution?

To legally dissolve a corporation, it is essential to draft a Plan of Dissolution, file the appropriate dissolution paperwork such as a Certificate of Dissolution, and address all tax obligations by submitting final tax returns.

Are there alternatives to winding down a business?

Yes, alternatives to winding down a business include pivoting the business model, exploring acquisition opportunities, and seeking new funding sources to adapt to market demands. These strategies can provide avenues for growth and sustainability instead of closure.

How can GEOS help?

At GEOS, we’ve mapped out the entity setup & maintenance processes in 80+ countries and packaged it into a convenient platform/service. We also provide ongoing services like Resident Directorship, Registered Address & Tax/Accounting to help clients through the process of employing regional teams with their new entity.

This article does not constitute legal advice.